Does IR35 apply to you as a contractor?

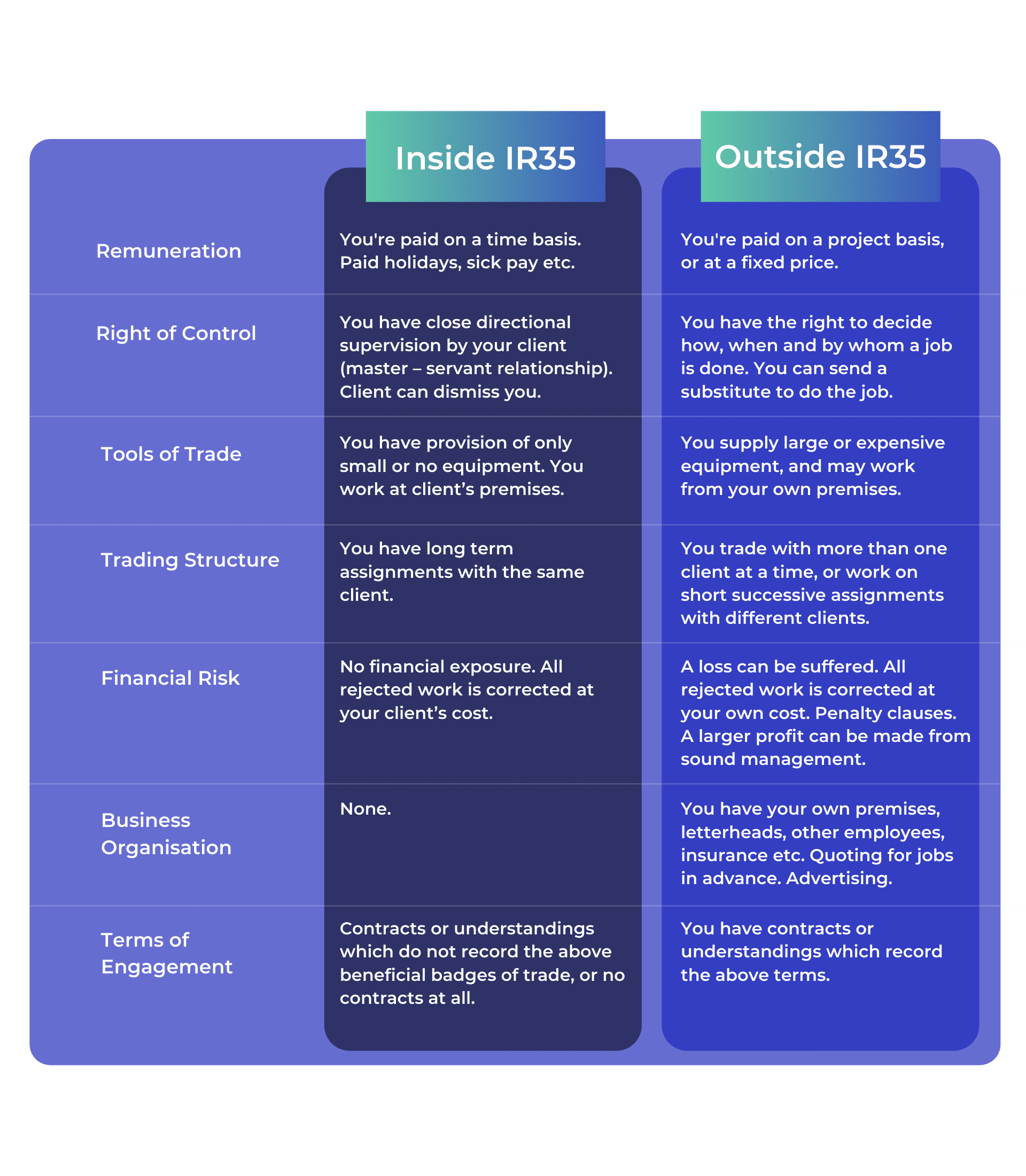

IR35 shouldn’t apply to contracts that are for services as opposed to employment. To help decipher this, follow our breakdown of the criteria set out by HMRC.

Mutuality of Obligation (MOO):

Does the end client have an obligation to offer you work, and do you in turn have to accept that work? An outside IR35 contract means you will be working on a project basis and once you’ve completed the work for that project, you’re not obligated to work on anymore work, and the client in turn is not obligated to offer any more work.

Supervision, Direction or Control (SDC):

This is dictated by how much control the end client has over how you complete the work for their company. A good example of this is someone dictating what work a person does and how they go about doing that work.

Right of Substitution:

This is the ability to demonstrate that the end client does not need you personally to deliver the service, that anyone with the relevant skills, qualifications and experience could deliver them successfully. It’s worth noting that if the client requires a certain contractor to provide these services and will not accept another equally skilled individual from the same LTD company then this impacts on the decision.

Financial Risk:

Is there an element of personal risk of taking on this contract? Are you responsible for errors made and would you have to fix those errors in your own time? In some cases, if there’s financial risk involved, you’ll have a requirement for Professional Indemnity Insurance in your contract.

Exclusivity:

Are you allowed to work for other clients whilst you work on this contract? If the answer is no then the HMRC may deem you inside IR35. Employee Benefits: Do you receive holiday pay, sick pay, pension contributions? If the answer is yes, then the HMRC may deem you inside IR35. Right of

Right of Dismissal:

Do you have a fixed notice period or can you be terminated immediately? If the answer is yes then the HMRC may deem you inside IR35.

Who determines your IR35 status?

The end client will need to carry out a HMRC CEST test for your placement to assess whether you are 'Inside IR35' or ‘Outside IR35’. After determining your placement via the HMRC CEST test, the client must complete a Status Determination Sheet (SDS) for you and submit it to DMCG Global.

Additional resources: Understanding IR35 CEST Tool.

.png)